south dakota property taxes by county

Real estate taxes are paid one year in arrears. Precint-1 Ethan Finance Office.

Property Taxes By State Quicken Loans

Please bring your tax notices with you.

. The states laws must be adhered to in the citys handling of taxation. The Minnehaha County Treasurers Office seeks to provide taxpayers with the best possible services to meet the continued and growing needs of Minnehaha County. 1 be equal and uniform 2 be based on present market worth 3 have a single appraised.

ViewPay Property Taxes Online. Redemption from Tax Sales. Please click HERE to go to payview your property taxes.

Learn what you need to file pay and find information on taxes for the general public. The Department of Revenue shares property assessment duties with local South Dakota County Directors of Equalization. Taxation of properties must.

Please allow 7-10 business days to process if paying online. Click here for any questions about tax. Motor vehicle fees and wheel taxes are also collected.

The effective average property tax rate in South Dakota is 122 higher than the national average of 107. If the county is at 100 of full and true value then the equalization factor the number to get to 85 of taxable value would. Lincoln County has the highest property tax rate in the state at 136.

You can look up current Property Tax Statements online. Go to the Property Information Search. POLLING PLACES FOR NOVEMBER 8th 2022 GENERAL ELECTION.

State Summary Tax Assessors. Property taxes are due October 31st. Spink County Government Redfield SD 57469 Home.

Then the property is equalized to 85 for property tax purposes. Enter only your house number. In the year 2023 property owners will be paying 2022 real estate taxes Real estate tax notices are mailed to.

Everything you need to know about games licensing and beneficiaries of the South Dakota Lottery. To find detailed property tax statistics for any county in South Dakota click the countys name in the data table above. South Dakota has 66 counties with median property taxes ranging from a high of 247000 in Lincoln County to a low of 51000 in Mellette County.

Tax payments may be sent. SDCL 10-24 In South Dakota property owners have a period of time during which they can repurchase redeem their property by paying the amount owed. This data is based on a 5-year study of median property tax.

Spink County Redfield South Dakota. Hamlin County Treasurer PO Box 267. Tax payments must be made for the exact amount only.

If you are a senior citizen or disabled citizen property tax relief applications are available through. The Treasurer is not only responsible for collecting property taxes for the county but the city and school districts as well. Second half property taxes are due by October 31.

While some industries pay property taxes others are responsible for. Hayti South Dakota 57241-0267. Look up statements online.

Property Tax Explainer 10 Insights Into West St Paul S Property Taxes West St Paul Reader

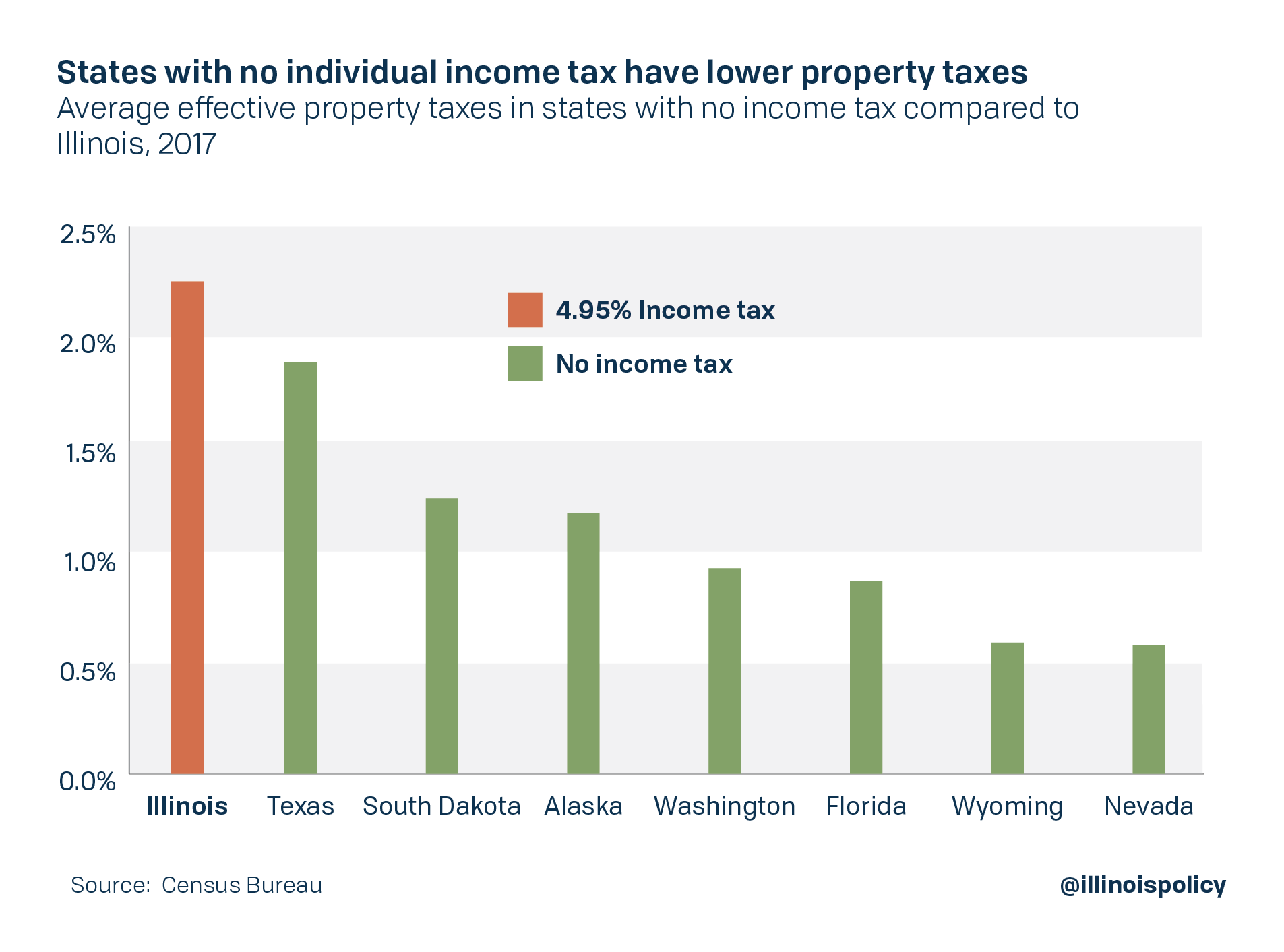

Illinois Property Taxes Rank No 2 In The Nation For Third Year Running

Property Tax South Dakota Department Of Revenue

Equalization Pennington County South Dakota

South Dakota Assessor And Property Tax Records Search Directory

Mchenry County North Dakota Home

Property Taxes A Function Of Levies Home Value And Also Residential Growth

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Property Taxes By State Highest To Lowest Rocket Mortgage

Property Tax Calculator Smartasset

Understanding Your Property Tax Statement Cass County Nd

Property Taxes Lincoln County Sd

North Dakota Property Tax Calculator Smartasset

Property Tax Calculator Smartasset

Governor Kristi Noem On Twitter Did You Know South Dakota Has Been Consistently Ranked As A Top State To Do Business Largely Due To Our Favorable Tax Environment And Limited Regulatory System